Vellet Cards

Vellet — Employee Travel& Expense Cards

Employee

Travel

Empower your team to spend abroad, stay compliant, and close books faster.

Who We Serve

- HR & Finance teams managing frequent travel

- Multinational SMEs and startups

- Field sales, consulting, operations, support

- Companies reimbursing in multiple currencies

Solutions

Travel & Expense Cards

- Issue per-employee or per-trip cards in seconds

- Set per diem, MCC, country limits

- Auto-collect receipts

- One-click ERP export

Team & Project Budgets

- Dedicated cards for projects/cost centers

- Real-time budget burn-down alerts

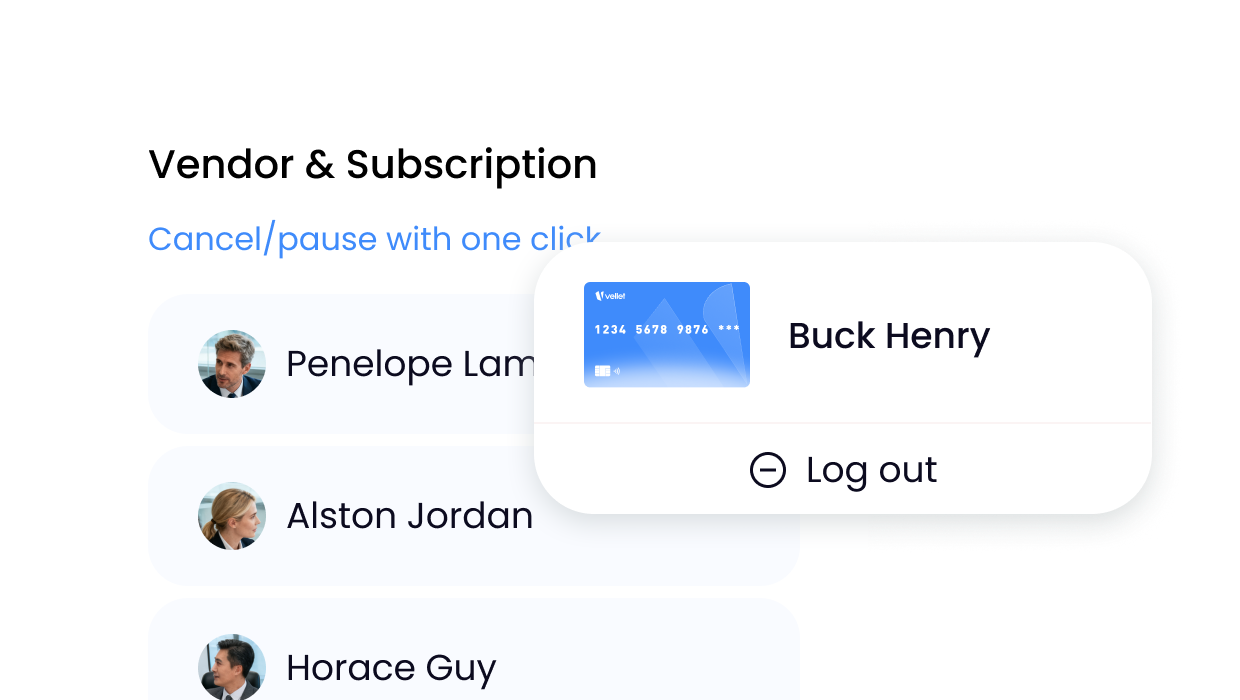

Vendor & Subscription Control

- Lock cards to specific merchants/currencies

- Cancel/pause with one click

Key Benefits

Policy-Driven Controls

Key Benefits

Instant Scalability

Key Benefits

Clear, Fast Close

Key Benefits

Secure & Compliant

Key Benefits

Multi-Currency Savings

Key Benefits

Product Features

- Instant Issuance

- Granular Controls

- Analytics

- Receipt Capture

- Workflows

- Integrations

Security & Compliance

At AIVANCE SOLUTIONS PTE. LTD., we understand that handling corporate travel and expense payments requires uncompromising standards in security and regulatory compliance. Our platform is built with a multi-layered approach to protect your data, transactions, and employees worldwide.

Data Protection & Privacy

- Encryption: All cardholder and transaction data are encrypted in transit (TLS 1.3) and at rest (AES-256).

- Data Residency: Flexible hosting options to comply with local data residency laws.

- Privacy by Design: GDPR, CCPA, and other global privacy regulations built into our product design.

Regulatory Compliance

- PCI DSS Level 1: Fully certified issuing and transaction processing.

- AML & KYC: Robust onboarding checks to meet FATF, HKMA, MAS and other jurisdictional requirements.

- Licensing Partnerships: Operate under licensed issuers and financial institutions in multiple regions.

Access Control & Identity Security

- Role-Based Access Control (RBAC): Fine-grained user permissions for finance, HR, and admins.

- SSO & 2FA: Enterprise-grade authentication with Single Sign-On and Two-Factor Authentication.

- Audit Logs: Immutable, time-stamped logs for full traceability.

Fraud Prevention & Risk Management

- Real-Time Monitoring: Velocity checks, MCC restrictions, country geofencing.

- AI-Powered Alerts: Suspicious activity detection using machine learning models.

- Dispute Management: End-to-end workflows for chargebacks and fraud claims.